Commentary from FundingShield’s CEO Ike Suri

Wire and title fraud risk reached a new record in the third quarter of 2022 at 47.9% of transactions having at least one risk issue. With the contraction in market transaction volumes the impact is that much more severe for lenders where a single wire or title fraud event could be catastrophic.

Business email compromise (BEC) attacks in real estate have appeared in media outlets such as Bloomberg’s recent article that shed light on this blind spot that has been overlooked from a risk prevention perspective. Much of the attention and focus is on educating market participants and consumers versus equipping teams with risk management tools to proactively defend against risk.

Consumer facing organizations such as the National Association of Realtors (NAR) are reporting on wire fraud consistently and the NAR website’s wire fraud resource page reported that 2300+ average complaints have occurred daily for the past 5 years. The FBI’s Internet Crime Center now highlights real estate wire fraud as one of the largest white collar crimes in terms of occurrence and impact and the FBI recognizes its data is based on what has actually been reported as much of the losses and risk is not reported or captured by FBI. The Consumer Financial Protection Bureau worked with trade organizations such as ALTA to provide videos to educate parties of the risk and what to look for in email communications. Further the MBA hosted a cross functional panel (that FundingShield participated in) across Title Industry executives, lender risk management executives and FinTech Risk vendors focused on discussing how to get ahead of the risk.

The rise notated by regulators, law enforcement, trade organizations and what we see here at FundingShield demonstrates that wire fraud prevention is a necessary tool in the enterprise risk arsenal. Not paying attention to this cybersecurity risk as we continue to digitize all aspect from application, to closing, to sourcing and listing properties is no longer an option for financial institutions and their clients. Education is a great first step but to avoid losses, lawsuits, delays in closing and reputational harm, risk prevention tools and strategies need to be deployed.

FundingShield uncovered several fraud schemes and prevented client losses working in coordination with title insurers, attorneys, lenders, and the security teams of closing agents. One common feature that the more recent attacks in Q3 2022 displayed was fraudsters not only controlling email communication but also hacking into phone systems of closing agents such that verbally confirmed wire details were being confirmed at legitimate phone numbers by the fraudulent parties. This is something FundingShield has seen in fraud scenarios for several years and our firm has procedures and controls to assure verification of source data to prevent these attacks from being successful.

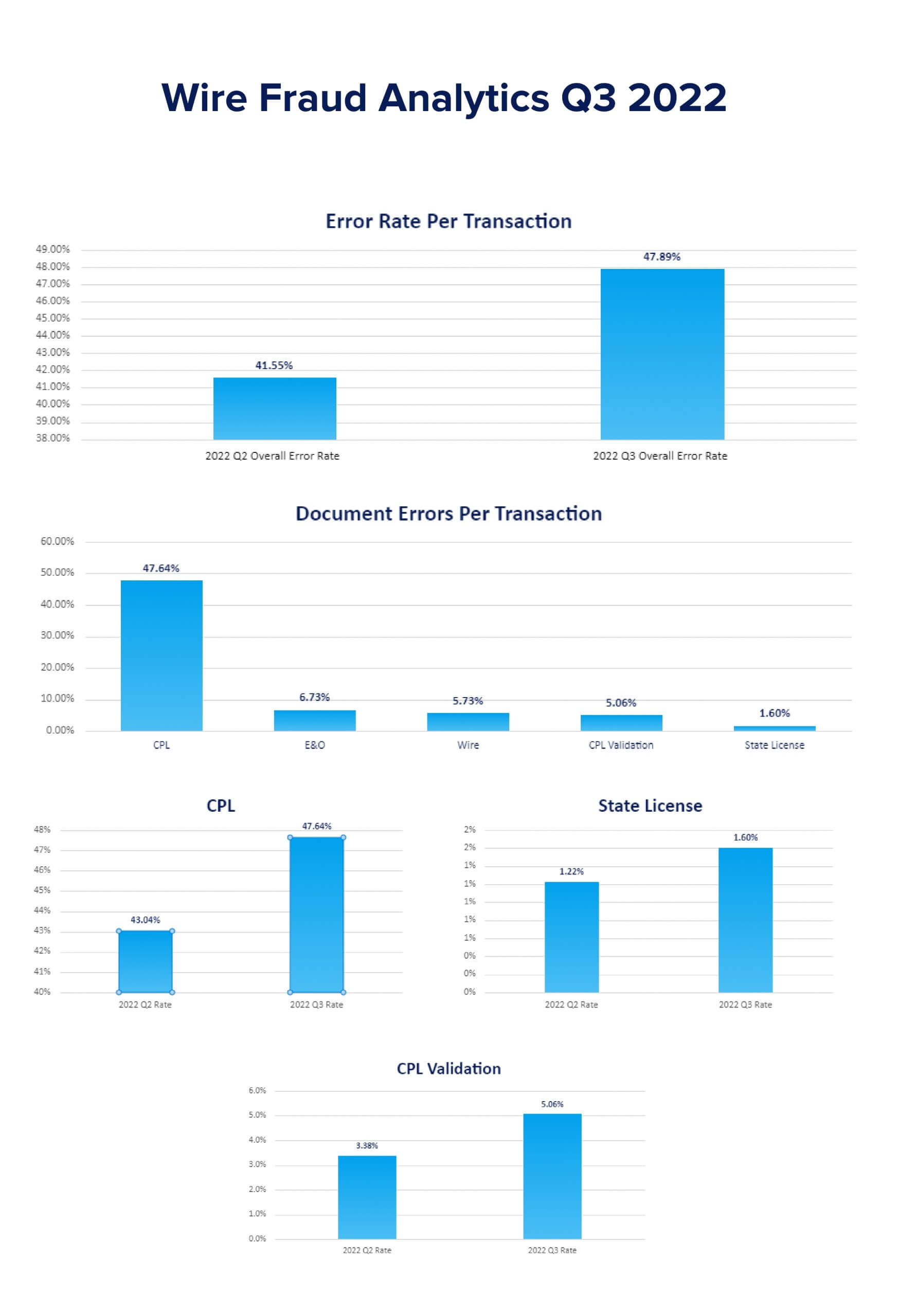

During Q3-2022 overall 47.9% percent of transactions had issues leading to wire & title fraud risk and 5%+ of transactions were not registered or valid in title insurer systems at time of closing.

Further there was a 35% increase in Closing Agent Insurance policy coverage gaps and nearly 50% increase in transaction data and title file order registration issues at time of close. We have seen client growth of 11% during the quarter as lenders manage resized organizations, an increase in fraud risk, and a desire to convert to variable cost structures due to dynamic transaction volumes. Our $5mm per transaction coverage, the only offering of its type in the market, is a key driver to growth as this is incredibly valuable in the current high-risk environment.

Analytics Q3 2022 v Q2 2022:

- 10.7% increase in CPL related errors

- 5.1% of transactions had CPL / agent validation related errors with title insurer systems

- 37% increase in insurance coverage issues

- 31% increase in licensing issues uncovered

Additional Context:

These issues highlight production errors, mis-representations, control issues, cyber-attacks and business email compromise events that create ideal conditions for fraudsters to prey. FundingShield helps prevent, identify and resolve these inefficiencies, threats and exposures in a timely manner so lenders can run their businesses without interruptions, reputational nightmares and/or losses by working with only valid, verified and vetted closing agents across the country.

About FundingShield

Fundingshield is a MISMO Certified FinTech offering B2B & B2B2C solutions delivering transaction level coverage against wire & title fraud, settlement risk, closing agent compliance & cyber threats while reducing operating costs and improving asset quality for real estate investors and mortgage finance companies including banks, credit unions and independent mortgage banks. FundingShield’s user-centric plug’n’play tools are scalable, pay-per-loan, secure, cloud-based and are integrated via API’s or LOS (Encompass) driving ROIs >200%. Fundingshield is a 3 time Housingwire TECH100 Winner for 2019, 2020 & 2021, CFO Tech Outlook Top 10 Financial Security Solution Provider, Ellie Mae Encompass partner and an IBM cloud services partner.