This post originally appeared on Qualia

Just halfway into 2021, venture capital activity in residential real estate technology had already reached an annual record of $6.2 billion. As technology floods the real estate market, are these new digital tools and business models transforming the borrower experience or impacting homebuyer expectations?

Qualia is monitoring consumer preferences in our Homebuyer Sentiment Index. In our latest installment, we commissioned Savanta, a third-party research firm, to track how homebuyers navigate the purchase journey from home search all the way to the closing date.

Our survey results underscore the importance of real estate professionals working together to deliver on homebuyer expectations. Borrowers are increasingly beginning their journey online and expect a fluid experience from home search all the way through closing. More than ever, real estate professionals must work in sync to deliver a more transparent and efficient transaction—and technology is making that possible.

Real estate agents set the tone for a digital homebuying journey

Qualia’s survey data underscores just how important the initial point of contact is for borrowers. 60% of recent homebuyers said that their real estate agent was their first point of contact (POC) when purchasing a home, and 54% of borrowers said they relied on their real estate agent as their main POC all the way through closing. The majority of homebuyers (53%) used an online “matching service” to connect them to a qualified real estate agent (e.g. Zillow, realtor.com®, and Redfin) or used online search to find their agent.

Unsurprisingly then, when it came to finding and selecting a lender to begin the mortgage finance process, borrowers mostly relied on their real estate agents. In fact, 44% of recent homebuyers followed the recommendation of their real estate agent to select their lender. Some borrowers (39%) took the initiative to find their lenders using online search.

All of this matters when it comes to delivering an experience consistent with the front end of the homebuying journey. As indicated by the data above, the borrower journey increasingly starts online and with a real estate agent as the primary POC.

A digital mortgage application offering is now nearly ubiquitous among lenders

The increase of digital touchpoints at the start of the homebuying journey is also evident when we explore the evolution of the mortgage application process.

In 2015, Quicken Loans launched Rocket Mortgage, the first completely online mortgage experience. It gave consumers the ability to input their information and get approved for a mortgage completely online. By January 2017, over 25 digital lending firms offered a similar automated mortgage application experience to consumers. Today, the line between digital lenders and traditional banks is blurring.

No longer is there a clear divide separating digital lending newcomers from long-standing lending institutions. In fact, digital front-end touchpoints—especially at application—are nearly ubiquitous among lenders. Our survey found that 92% of homebuyers leveraged online processes when obtaining a mortgage. More than one-third applied for and completed the mortgage application completely online (36%). For returning homebuyers, this percentage jumped to 44%.

The digital gap: expectation vs. reality during the closing process

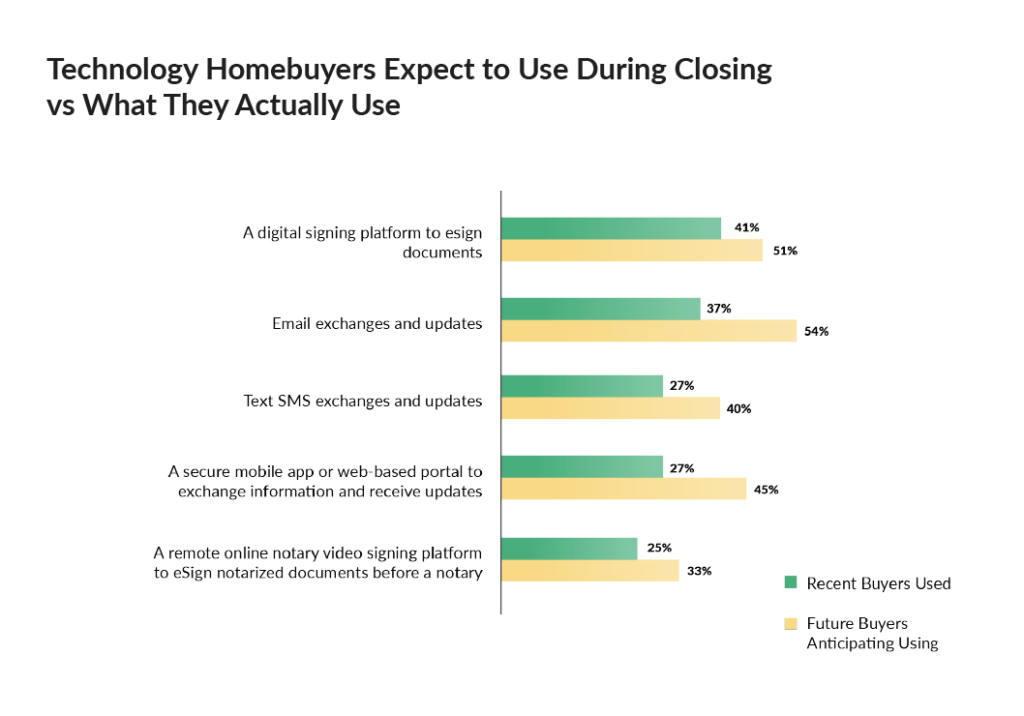

The proliferation of digital tools during the mortgage application process may impact borrowers’ expectations further down the line at closing. Qualia’s survey found that consumers expect a variety of digital touchpoints prior to and during the closing, yet these expectations are largely being unmet.

Overall, there is a sizable gap between the number of technology homebuyers expect during the closing process and what they actually use when they close on a home. The majority (51%) of future homebuyers anticipate they will use a digital signing platform to eSign closing documents; however, only 40% of recent homebuyers report using an eSign platform. Similarly, 45% of future homebuyers expect to use a secure mobile app or web-based portal to exchange information and receive updates, yet only 27% of recent homebuyers report using one.

Over the past year, remote online notarization (RON) eClosings have dominated industry news. And while investment in eClosing platforms has certainly increased for both mortgage lenders and title companies, actual implementation is still lagging due to a number of factors including local legislation, hesitancy among secondary market players, and still-needed coordination (and interoperable technology) between lenders and title companies. Our survey found that only 13% of homebuyers experienced a fully digital closing, yet 62% report that they would like to experience a fully digital closing.