This post originally appeared on Qualia

Last year, record refinance activity nearly disguised the challenges of the closing process. After all, refinances require fewer participants and generally less emotional stress on the part of the borrower.

Now, economists predict a strong purchase market ahead which means higher production costs and tighter margins for mortgage lenders and title companies alike.

While there are challenges of a purchase market, there are also solutions. And right now, lenders with these solutions have a competitive advantage. Leading mortgage lenders possess origination and production software that integrates seamlessly with that of their title partners’ core workflow software.

Requiring title companies to adopt your tech solutions just won’t work

Title companies take on double the work during a purchase transaction. Not only must they move a file through closing by managing the title insurance underwriting process, title examination, and curative work (as they would in a refinance transaction), now, they must also manage the emotions of a home purchase. For example, title companies must field calls and keep an eye on accumulating emails from real estate agents and mortgage lenders requesting status updates on the closing timeline from anxious borrowers.

The last thing a title company has time to do is learn a new lender technology solution—especially when that learning curve is multiplied by ten or twenty different solutions from dozens of different lender partners. For example, as more lenders adopt third-party eClosing portals, these systems will require title companies to leave their core workflow systems, download documents from their system of record, and upload the documents into the third-party portal. This is just one area where title companies are forced to interrupt their workflows to login to another system outside of their core environment.

The solution: integrated technology

In the past, integrating lender and title company workflow systems required a robust IT team on both the lender and title sides of the equation. Today, cloud-based platforms like Qualia are leveling the playing field for title, escrow, and mortgage lending businesses to expand their technology capabilities without significant IT investment.

Cloud-based platforms enable information to be exchanged between systems in a standardized way. This enables businesses to automate information exchange and create overall efficiencies in overlapping operations.

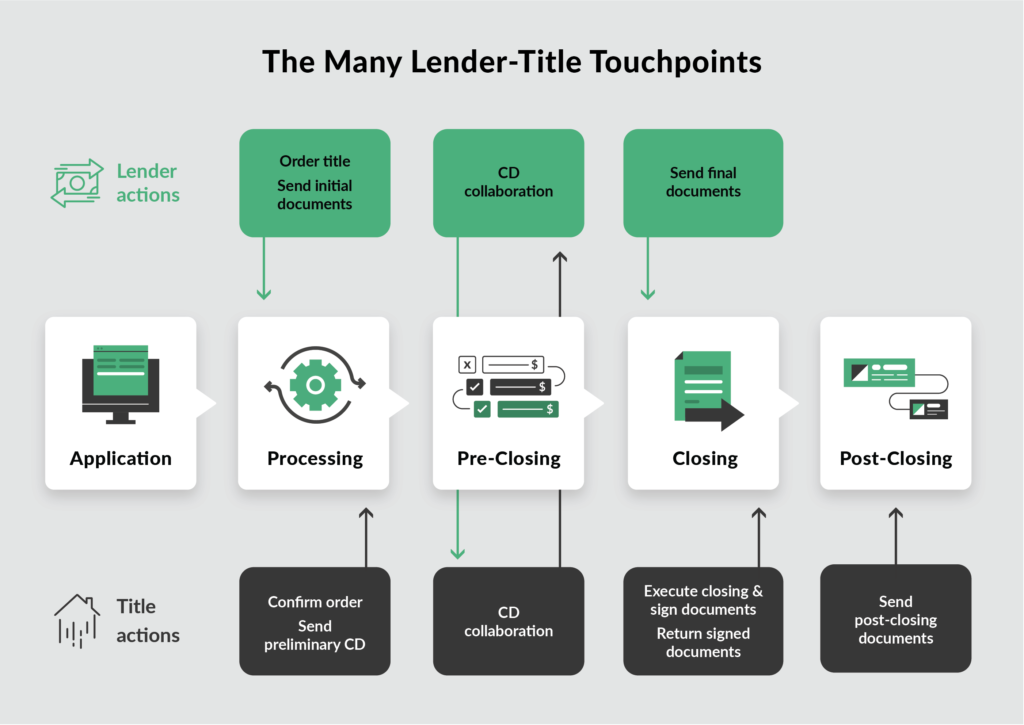

Integrated technology is crucial for lenders and title companies. For a given loan, lenders will work through nearly a dozen points of collaboration with their title partners—integrated technology helps to streamline and even automate many of these touchpoints.

Qualia’s system of engagement

Qualia, the system of record for thousands of title companies across the country, is making lender and title touchpoints easier. Our platform brings the many points of interaction between lenders and title companies into one common system of engagement.

While cloud-based systems exist across the mortgage loan lifecycle to streamline different points of collaboration between lenders and title companies, Qualia is the only single system of engagement for lenders to work with their title partners during the application, processing, pre-closing, closing, and post-closing.